Company Liquidation Can Be Fun For Everyone

Table of ContentsSome Known Questions About Company Liquidation.The Of Company LiquidationCompany Liquidation Can Be Fun For EveryoneCompany Liquidation - An OverviewSome Known Questions About Company Liquidation.

A liquidator is especially appointed to look after the ending up of a business's events in order for it to be shut down typically when the company is declaring bankruptcy. The liquidator is an impartial 3rd party that supervises the sale of business assets in order to repay any kind of arrearages.Their role consists of, however is not limited to: Unbiased Overseer: A liquidator is entrusted with working as an impartial third party to look after the whole company liquidation procedure. Create Declaration of Matters: Liquidators must produce a detailed statement of affairs record. This record is dispersed to creditors, describing the existing economic standing of the business at the time of its liquidation.

After the liquidation of a firm, its presence is erased from Firms House and it discontinues to be a lawful entity. If directors browsed the process uncreative, there would certainly be no penalties or individual responsibility for strong financial debts expected. Currently, with a tidy slate, directors can discover brand-new company chances, though expert appointment is recommended.

What Does Company Liquidation Do?

If even more than 90% of all firm investors concur, liquidation can take location on short notice within seven days, the minimum statutory notification for financial institutions. Generally, the bigger the liquidation and the even more possessions and funding the company has, the longer the process will certainly take.

We comprehend that no two companies are the same, which is why we will put in the time to obtain to understand your service so we can suggest the very best course of action for you. We just function in your ideal rate of interests, so you can be completely confident in the service we give.

The Only Guide to Company Liquidation

In the UK, there is a set procedure to folding or reorganizing a restricted company, whether it is solvent or financially troubled. This process is referred to as liquidation and can just be dealt with by an accredited insolvency professional (IP) in accordance with the Bankruptcy Act 1986. There are four primary sorts of firm liquidation process: Financial institutions' Voluntary Liquidation (CVL); Compulsory liquidation; Management; and Participants' Voluntary Liquidation (MVL).

In these conditions, it is very important that the business discontinues trading; if the service proceeds to trade, the directors can be held personally accountable and it might result in the insolvency practitioner reporting wrongful trading, called misfeasance, which might have a peek at these guys lead to legal activity. The directors select an insolvency professional and as soon as this has been concurred and confirmed, there is a meeting with the investors.

Certainly, if there are no investors, this step of the process is not essential (Company Liquidation). The IP takes control of the business and begins the business liquidation process. The directors are no longer involved in what occurs, including the sale of the business's possessions. If the supervisors desire any of the properties, they can notify the IP.

The Company Liquidation Statements

The major distinction is that the business's lenders applied to the court for a winding up order which compels the financially troubled business into a liquidation procedure. In many cases, financial institutions take this activity as a last option since they have not obtained settlement with various other try this site kinds of negotiation. The court appoints an insolvency specialist, likewise recognized as an official receiver, to conduct the mandatory company liquidation procedure.

This kind of business liquidation is not voluntary and directors' conduct is reported to the UK's Secretary of State once the liquidation process has been completed. Therefore, any kind of director that falls short to work together with the IP or has actually been involved in director misconduct, or an illegal act, may cause serious consequences (Company Liquidation).

It is made use of as a way to safeguard the firm from any type of lawful activity by its creditors. The directors of the business concur to make regular repayments to resolve their financial debts over an amount of time. The designated manager takes care of the voluntary administration procedure, and obtains the repayments which they after that distribute to financial institutions according to the agreed quantities.

Fascination About Company Liquidation

This offers the business with time to establish a plan going forward to save the firm and avoid liquidation. At this point, supervisors hand control of the business over to the designated administrator. If a firm is solvent but the directors and shareholders desire to close the business, a Members Volunteer Liquidation is the right alternative.

The more info here company liquidation process is handled by a liquidator designated by the supervisors and investors of the company and they must authorize a statement that there are no lenders remaining. The liquidation process for an MVL resembles that of a CVL because properties are realised yet the profits are distributed to the directors and the shareholders of the business after the liquidator's fees have actually been paid.

Michael Oliver Then & Now!

Michael Oliver Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Rachael Leigh Cook Then & Now!

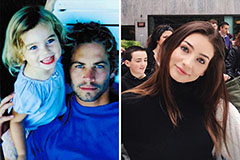

Rachael Leigh Cook Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!